Iran’s deputy minister for industry and trade has said that bank seizures of companies and factories has increased this year, amid a deepening economic crisis.

Mehdi Niyazi told local media that from April to September 1,793 industrial and trading companies were seized by banks after they failed to make loan payments. Most banks in Iran are fully or partly state owned.

Niyazi added that over 60 percent of companies in Iran have financial problems because of high inflation, estimated to be close to 50 percent and lack of finance.

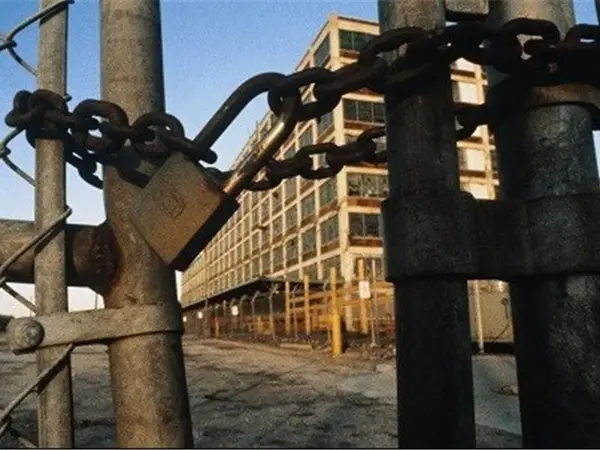

He explained that many companies after seizure of ownership by banks stopped operations, a situation that would increase an already high unemployment rate. One bank that just last year had 60 companies under its receivership now has ownership of 160 firms.

The deputy minister partly blamed high interest rates the banks charge for the insolvency of companies struggling amid sanctions and an economic crisis.

Iran’s weak economy took a turn for worse in 2018 when the United States withdrew from the 2015 nuclear agreement and imposed tough sanctions on the country.